Additionally, the split indicates that share value has been increasing, suggesting growth is likely to continue and result in further increase in demand and value. Companies often make the decision to split stock when the stock price has increased enough to be out of line with competitors, and the business wants to continue to offer shares at an attractive price for small investors. The date of payment is the third important date related to dividends. This is the date that dividend payments are prepared and sent to shareholders who owned stock on the date of record. The related journal entry is a fulfillment of the obligation established on the declaration date; it reduces the Cash Dividends Payable account (with a debit) and the Cash account (with a credit).

Treasury Stock

Therefore, if the shares of Bayless are worth $28,000 at December 31, Year One, Valente must adjust the reported value from $25,000 to $28,000 by reporting a gain. In the example above, the additional paid-in capital of $45,000 is calculated by the selling price of the 50 common shares of $50,000 (50 shares x $1,000 per share), minus the par value of the 50 common shares of $5,000 (50 shares x $100 par value). To see the effects on the balance sheet, it is helpful to compare the stockholders’ equity section of the balance sheet before and after the small stock dividend. For corporations, there are several reasons to consider sharing some of their earnings with investors in the form of dividends. Many investors view a dividend payment as a sign of a company’s financial health and are more likely to purchase its stock. In addition, corporations use dividends as a marketing tool to remind investors that their stock is a profit generator.

What is an Income Tax Provision?

If you don’t make an entry, you likely will eventually end up with a gain of $39,900 ($40K – $100) that you don’t have because you didn’t record your basis of $40K. If, instead, the fair value at year-end had been only $21,000, a $4,000 unrealized loss will appear on Valente’s income statement to reflect the decline in value ($25,000 historical cost dropping to $21,000 fair value). PwC refers to the US member firm or one of its subsidiaries or affiliates, and may sometimes refer to the PwC network. This content is for general information purposes only, and should not be used as a substitute for consultation with professional advisors. The Walt Disney Company hasconsistently spent a large portion of its cash flows in buying backits own stock.

- When a company issues a stock dividend, it distributes additional shares of stock to existing shareholders.

- Therefore, if the shares of Bayless are worth $28,000 at December 31, Year One, Valente must adjust the reported value from $25,000 to $28,000 by reporting a gain.

- Common shares may also be referred to as common stock, ordinary shares, junior equity, or voting shares.

- Likewise, the company needs to record the purchase of treasury stock as a contra account to stockholders’ equity on the balance sheet.

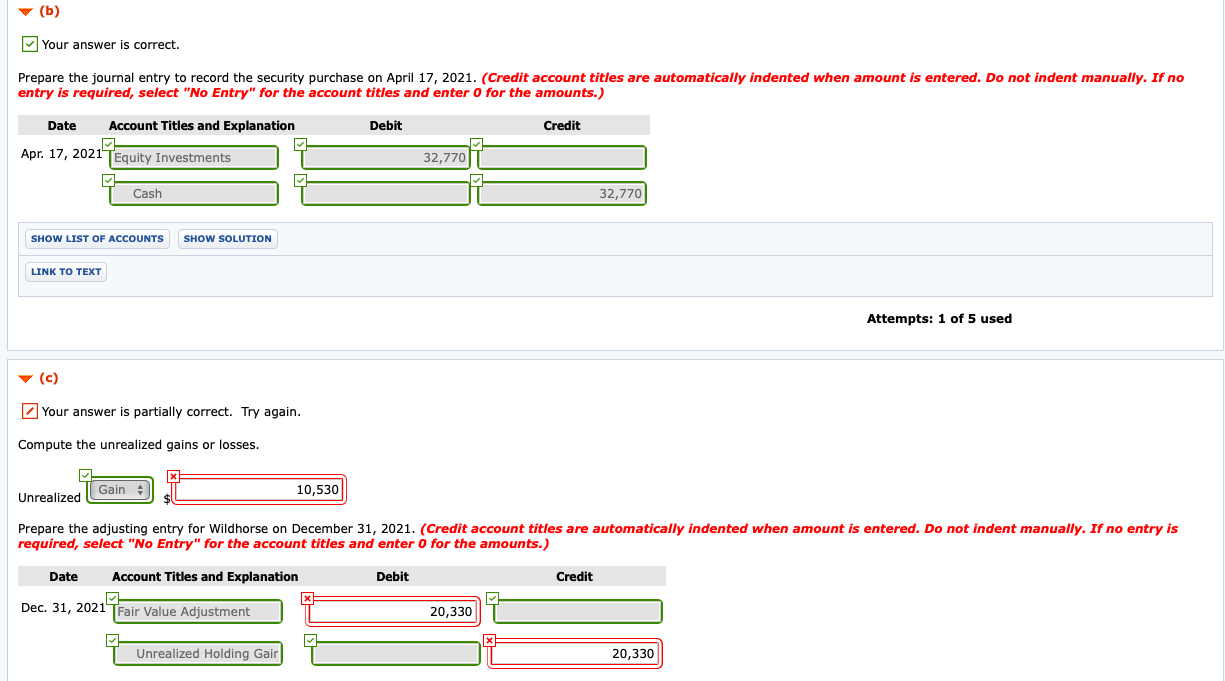

Journal Entry for Purchase of Stock Investment

A purchase can also create demand for the stock, which in turn raises the market price of the stock. Sometimes companies buy back shares to be used for employee stock options or profit-sharing plans. We can make the journal entry for investment in shares of another company by debiting the stock investment and crediting the cash account. Additionally, when we receive the dividend from the investment that we have made by purchasing shares of another company, we also need to record it into our accounting record. Though, we may record the cash dividend received as the dividend revenue or as a reduction of our investment balance depending on the percentage of ownership we have in the investee company. Because of the short-term nature of this investment, Valente might sell these shares prior to the end of the year.

The company can raise the capital by issuing equity or debt security to the capital market. If the company issue debt to the market, they have obligation to pay for the annual interest. etsy sales tax Moreover, on the maturity date, the issuer has to pay back the principal amount. Common shares may also be referred to as common stock, ordinary shares, junior equity, or voting shares.

Issuing No-Par Common Stock with a Stated Value

ThePreferred Stock account increases for the par value of thepreferred stock, $8 times 1,000 shares, or $8,000. The excess ofthe issue price of $45 per share over the $8 par value, times the1,000 shares, is credited as an increase to Additional Paid-inCapital from Preferred Stock, resulting in a credit of $37,000. When a company issues stock for property or services, thecompany increases the respective asset account with a debit and therespective equity accounts with credits. Treasury stock transactions have no effect on the number of shares authorized or issued. Because shares held in treasury are not outstanding, each treasury stock transaction will impact the number of shares outstanding.

The 700,000 shares are issued at a price of 2.00 each and the company receives 1,400,000 from the shareholders in cash. If the authorized number of shares is 1,800,000, it can still issue a further 1,100,000 shares at a later date to raise additional cash. U.S. GAAP requires investments in trading securities to be reported on the balance sheet at fair value.

Duratech will pay the market price of the stock at $25 per share times the 800 shares it purchased, for a total cost of $20,000. The following journal entry is recorded for the purchase of the treasury stock under the cost method. After the distribution, the total stockholders’ equity remains the same as it was prior to the distribution. The amounts within the accounts are merely shifted from the earned capital account (Retained Earnings) to the contributed capital accounts (Common Stock and Additional Paid-in Capital).